Grant County Loses to Ark Park – Again

By Dan Phelps.

Posted with permission. Mr. Phelps sent this note to us by way of an e-mail.

This is very old news, but I just learned of the resolution of the lawsuit Grant County Board of Education v. Ark Encounter. Unsurprisingly, the Grant County News (a very pro-Ark newspaper) did not cover the outcome of this case, although the paper had covered the initial lawsuit. The Louisville Courier-Journal also did a story on the initial lawsuit on August 27, 2019. I discussed the situation with many people back in 2019, but was unaware of the final result until now, since it was unreported outside legal databases. The final decision (summarized briefly below) was not given until July 29, 2020, and was not widely reported.

Since the school board lost the lawsuit in 2020, the following is moot, but shows yet another way the Ark has shortchanged the locals.

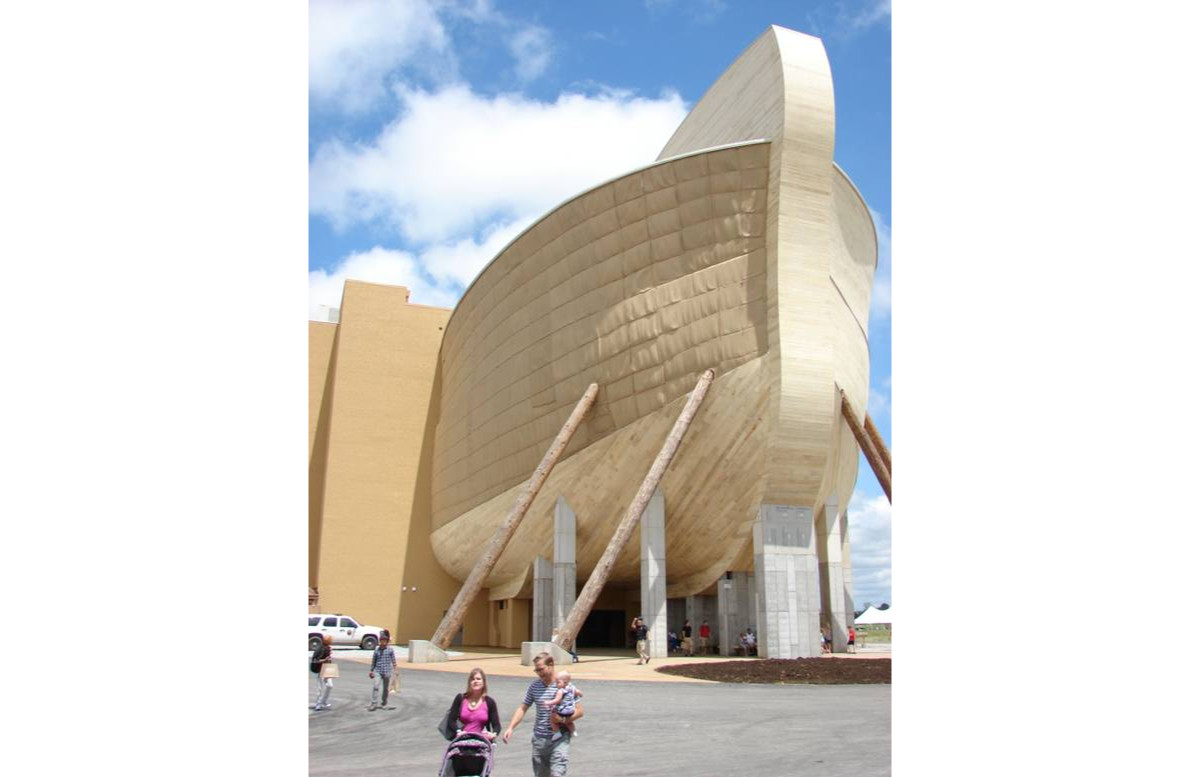

As a result of the lawsuit, Grant County education is, remarkably, going to be funded by taxes on the Ark at less than 50 % of what the Ark itself claims it is worth. AiG/Crosswater Canyon claim the Ark is worth well more than $100 million on their Form 990’s submitted to the IRS. The >$100 million amount makes AiG/Ark look better when borrowing money from financial institutions. However, the local Property Value Administrators evaluate the Ark at only $48 million for taxes (and, further, the Ark does not pay the full property tax amount because of an agreement/incentive given them before the Ark was built). Thus the financially strapped local schools do not receive as much tax money as they would if the PVA had evaluated the Ark at what AiG says it is worth.

Appendix.

Grant County Board of Education v. Ark Encounter, LLC, No. 19-CI-00204 (Grant Cir. Ct. July 29, 2020, affirming, File No. K18-S-15, Final Order No. K-25927 (KCC May 31, 2019) – Property Tax – Standing to Appeal Assessment The Board of Education (BOE) attempted to appeal PVA’s tax assessment of Ark Encounter property assessed at $48 million, alleging a value of $130 million. The KCC [Kentucky Circuit Court] dismissed the BOE’s appeal for lack of standing under the statute since the BOE was not a taxpayer or an aggrieved party, while also noting that historically this has never been done. On appeal to the Grant County Circuit Court, the parties entered an Agreed Order affirming the Final Order of the KCC.